So these revenues include the amount earned regardless of whether the cash is received or not. So, to prepare an income statement, you will first need to generate the trial balance report. Publicly listed companies are mandated to prepare financial statements on a quarterly and annual basis, whereas, small businesses are not required to follow such strict reporting rules.

Operating profit margin

After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals. Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community. When you depreciate assets, you can plan how much money is written off each year, giving you more control over your finances. Indirect expenses like utilities, bank fees, and rent are not included in COGS—we put those in a separate category. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

A short refresher on income statements

There’s only so much you can do to improve your bottom line by cutting expenses. At some point, you’ll hit a ceiling, and the only way to grow the bottom line is to grow your revenue. A cash flow statement tells you how much cash you have on hand and where it came from.

Ask Any Financial Question

It covers material, labour, and overhead costs that are directly used to produce the goods and services sold by your business. As we mentioned earlier, an income statement is also referred to as a statement of operations, statement of earnings, statement of income, or profit and loss statement. QuickBooks tracks and organizes all of your business’s accounting data, making it easy to access and review your income statement.

Income From Continuing Operations

- If a company is publically traded, its income statement must conform to gaap standards.

- The opinion requires that three items require disclosure in the income statement.

- After discounting for any nonrecurring events, it’s possible to arrive at the value of net income applicable to common shares.

For small businesses with few income streams, you might generate single-step income statements on a regular basis and a multi-step income statement annually. If you have more than a few income streams or a complicated financial landscape, you might use multi-step income statements to get a better view of your profits and losses. However, real-world companies often operate on a global scale, have diversified business segments offering a mix of products and services, and frequently get involved in mergers, acquisitions, and strategic partnerships.

Calculate Non-Operating Expenses, Income, and Others

It is one of the most heavily scrutinized financial statements issued by every organization. Because of this, it is critical for users to have a sound understanding of the story every income statement is trying to tell. The income statement and the cash flow statement are two out of the three components of a financial statement, the other being https://www.kelleysbookkeeping.com/ the balance sheet. These costs include wages, depreciation, and interest expense among others. Cost of goods sold expenses are reported in the gross profit reporting section while the operating expenses are reported in the operations section. Other expenses are reported further down the statement in the other gains and losses section.

We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Net profit, also called “net sales” or “net earnings,” is the total profit for your business. How you calculate this figure will depend on whether or not you do cash or accrual accounting and how your company recognizes revenue, especially if you’re just calculating revenue for a single month. Here’s an income statement we’ve created for a hypothetical small business—Coffee Roaster Enterprises Inc., a small hobbyist coffee roastery. There are situations where intuition must be exercised to determine the proper driver or assumption to use.

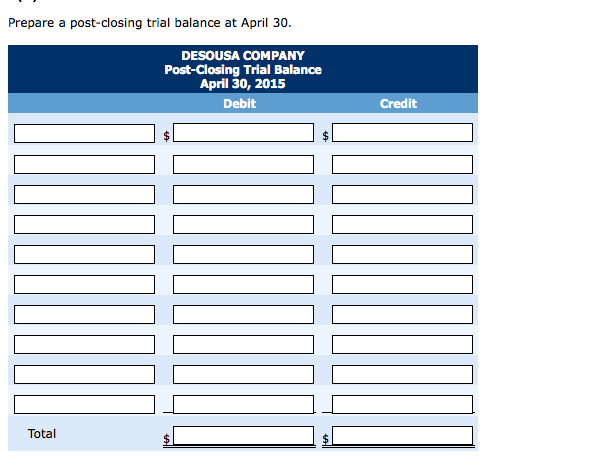

The single-step format is useful for getting a snapshot of your company’s profitability, and not much else, which is why it’s not as common as the multi-step income statement. But if you’re looking for a super simple financial report to calculate your company’s financial performance, single-step is the way what are the purpose of a post closing trial balance to go. The next section is the operating income, which is calculated by subtracting the operating expenses from the gross profit. This helps the users of the financial statements understand the capability of the company to generate profits before taking into account the impact of the financing activities.

For example annual statements use revenues and expenses over a 12-month period, while quarterly statements focus on revenues and expenses incurred during a 3-month period. The purpose of an income statement is to show a company’s financial performance over a given time period. Operating Income represents what’s earned from regular business operations. In other words, it’s the profit before any non-operating income, non-operating expenses, interest, or taxes are subtracted from revenues. EBIT is a term commonly used in finance and stands for Earnings Before Interest and Taxes.

Weiss asked the court − a judge has not yet been assigned − to set a date to formally process the plea agreements. Weiss began in 2018 with questions about taxes on overseas business deals, after his work in Ukraine and China drew federal scrutiny. U.S. Attorney David Weiss filed a letter in federal court Tuesday citing the charges and the plea agreement. In one case, the president’s son will plead guilty to the tax charges, which allege willful failure to pay federal income tax. In another case, he agreed to enter a pretrial diversion agreement for the gun offense, in which he acknowledged unlawful possession of a Colt Cobra 38SPL revolver, despite being addicted to drugs. “Last year, we pre-filled over 111 pieces of information into people’s tax returns,” he notes.

Likewise, non-operating income is the income not earned from core business activity. For example, profit on the sale of investments, gain on the sale of fixed assets, etc. Business entities typically show interest expense and interest income as a special line item in the income statement. This is typically undertaken to show earnings before interest and tax and earnings before tax. As stated above, an income statement is prepared on an accrual basis of accounting.

Instead of looking at one income statement at a time from different periods, horizontal analysis compares them side-by-side in one view. Other costs that would be counted https://www.business-accounting.net/what-qualifies-as-general-administrative-expenses/ under expenses would be operating and non-operating expenses. This could include things like marketing, payroll, and overhead expenses, such as insurance and rent.

Current practice has modified this meaning slightly to include only those operating events occurring in the current year. A Certified Public Accountant (CPA) can take those taxing financial tasks off your plate and help you avoid costly mistakes, leaving you with peace of mind to take your startup to new heights. After reducing COGS and general expenses, interest expense is the third place you look to improve your bottom line. You should do this with help from your accountant, who may recommend you restructure your debt, or prioritize paying down certain higher interest debts over others.